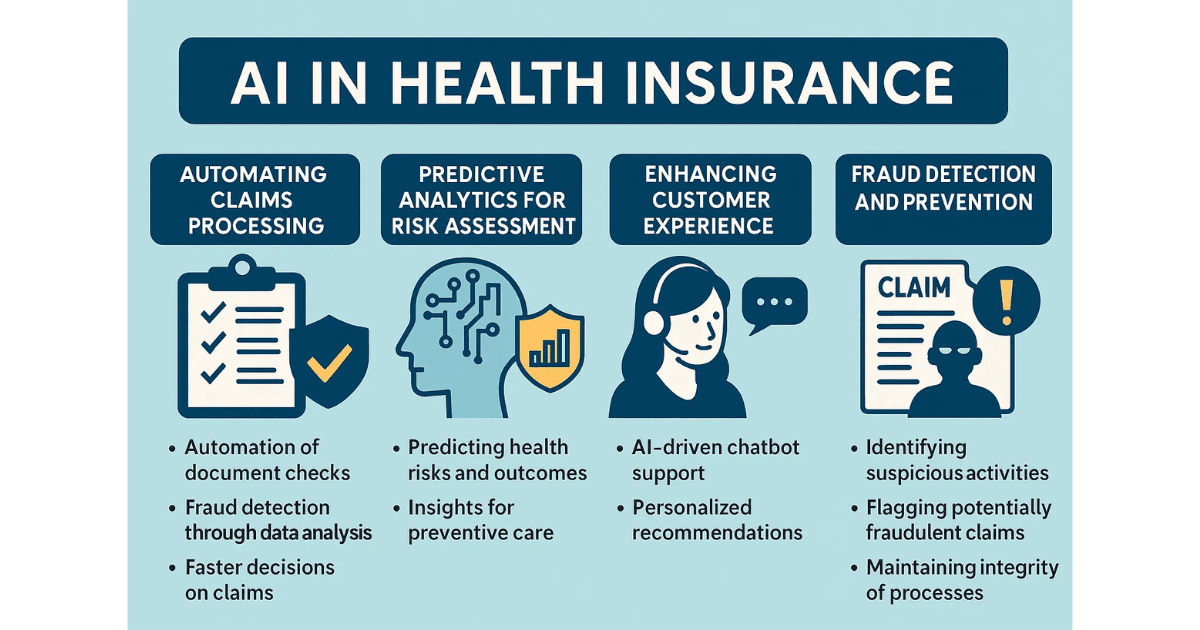

Artificial Intelligence (AI) is revolutionizing the health insurance sector, reshaping how companies optimize processes, engage customers, and reduce costs. In an industry traditionally known for its complex, time-consuming workflows, AI brings a much-needed transformation. According to McKinsey, insurers leveraging AI can reduce operational costs by up to 30%, highlighting the immense potential of these technologies.

Health insurance companies face increasing demands for efficiency and personalization. AI offers innovative solutions to tackle these challenges, from automating routine tasks to providing data-driven insights that enhance decision-making. By adopting AI-driven approaches, insurance companies not only streamline operations but also deliver a more personalized experience to policyholders. For example, AI-powered tools have helped insurers speed up processing by 60%, reducing customer wait times significantly.

The future of AI in health insurance is not just about improving current processes but also about introducing new capabilities such as real-time risk assessment, predictive analytics, and automated customer interactions. This article explores how AI is transforming key areas of health insurance, from claims processing to fraud detection and customer engagement.

Automating Claims Processing

One of the most significant impacts of AI in health insurance is automating claims processing. By leveraging machine learning algorithms, insurers can quickly assess claims, identify discrepancies, and ensure faster payouts. This automation not only improves customer satisfaction but also reduces human error and operational expenses. For instance, AI-powered claim verification can flag anomalies, such as duplicate submissions or inconsistent data, enabling real-time intervention.

Key Takeaways:

<ul style="list-style-type: none; padding-left: 0;">

<li>- Automates document verification, reducing manual errors</li>

<li>- Enhances fraud detection through anomaly tracking</li>

<li>- Speeds up decision-making with real-time processing</li>

</ul>

Predictive Analytics for Risk Assessment

AI-powered predictive analytics allow insurers to assess risk with greater precision. By analyzing vast datasets, including patient history and demographic information, AI can forecast potential health issues and recommend preventive care. This approach not only improves customer health outcomes but also helps insurers minimize costs associated with chronic illnesses or unplanned hospitalizations.

Real-Life Example: A leading health insurance provider implemented AI to predict chronic illness risks, reducing hospitalization rates by 20% in just one year.

Enhancing Customer Experience

Personalization is key in modern health insurance, and AI enables companies to deliver tailored services. Chatbots and virtual assistants can provide 24/7 support, guiding users through policy options and answering queries. Moreover, AI-driven recommendation engines can suggest the most suitable insurance plans based on individual health profiles and past interactions.

Quick Insights:

<ul style="list-style-type: none; padding-left: 0;">

<li>- Chatbots offer round-the-clock assistance</li>

<li>- Personalized recommendations enhance customer satisfaction</li>

<li>- Reduces response time with automated query handling</li>

</ul>

Fraud Detection and Prevention

AI is instrumental in identifying fraudulent activities within health insurance. By continuously monitoring data patterns and detecting irregularities, AI systems can flag suspicious claims, such as fabricated medical histories or inflated charges. This proactive approach significantly reduces financial losses and maintains the integrity of insurance processes.

Best Practice: Implementing AI-powered anomaly detection can reduce fraudulent claim payouts by up to 50%.

Future Outlook

The integration of AI into health insurance is just beginning. As technologies like natural language processing (NLP) and computer vision evolve, the potential for enhanced data analysis and more nuanced customer insights will grow. Insurers that adopt AI-driven solutions will be better positioned to meet the evolving demands of the industry.

Conclusion

Artificial Intelligence is transforming health insurance by improving efficiency, personalizing customer experiences, and combating fraud. As adoption continues to rise, insurers who embrace AI-driven innovation will maintain a competitive edge in the evolving healthcare landscape. Including actionable insights and real-world applications will ensure that AI becomes a sustainable driver of success in the insurance domain.